2/15/2026

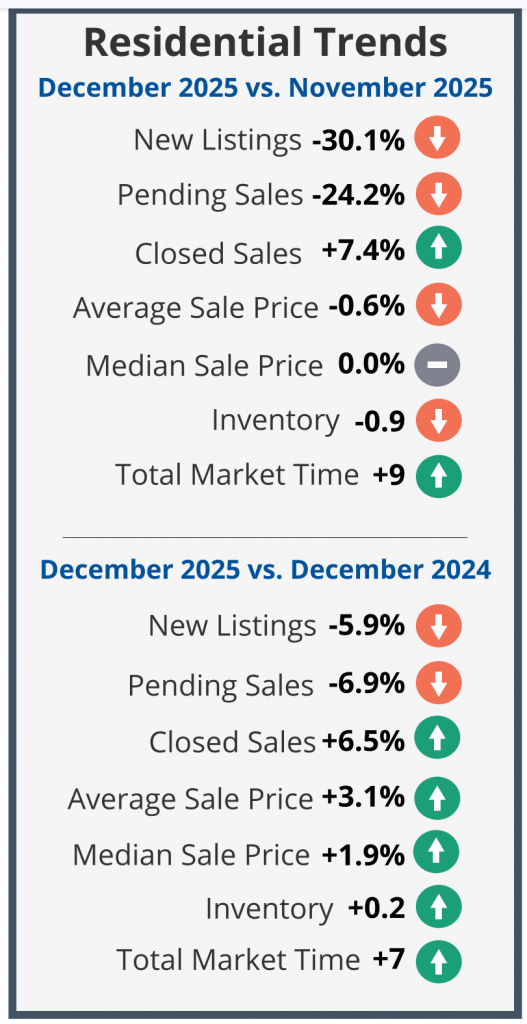

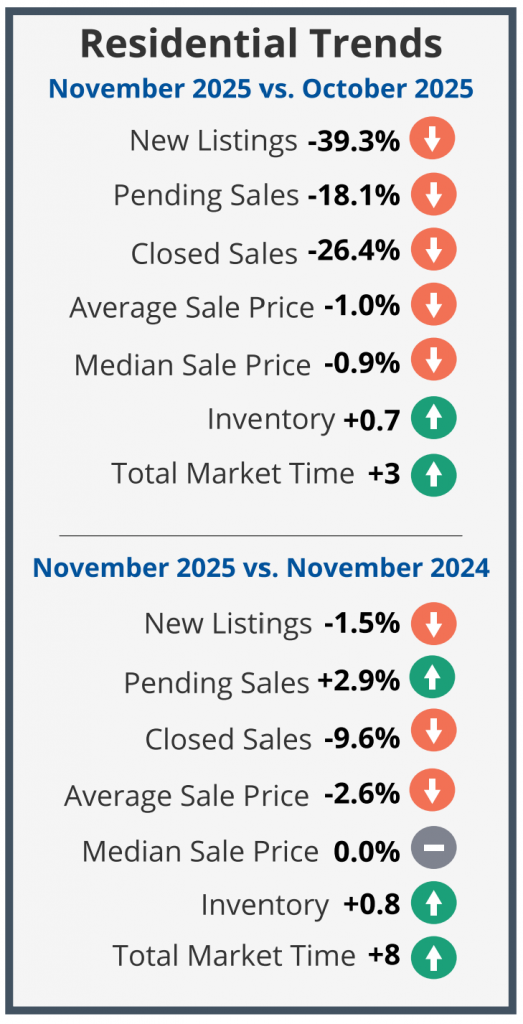

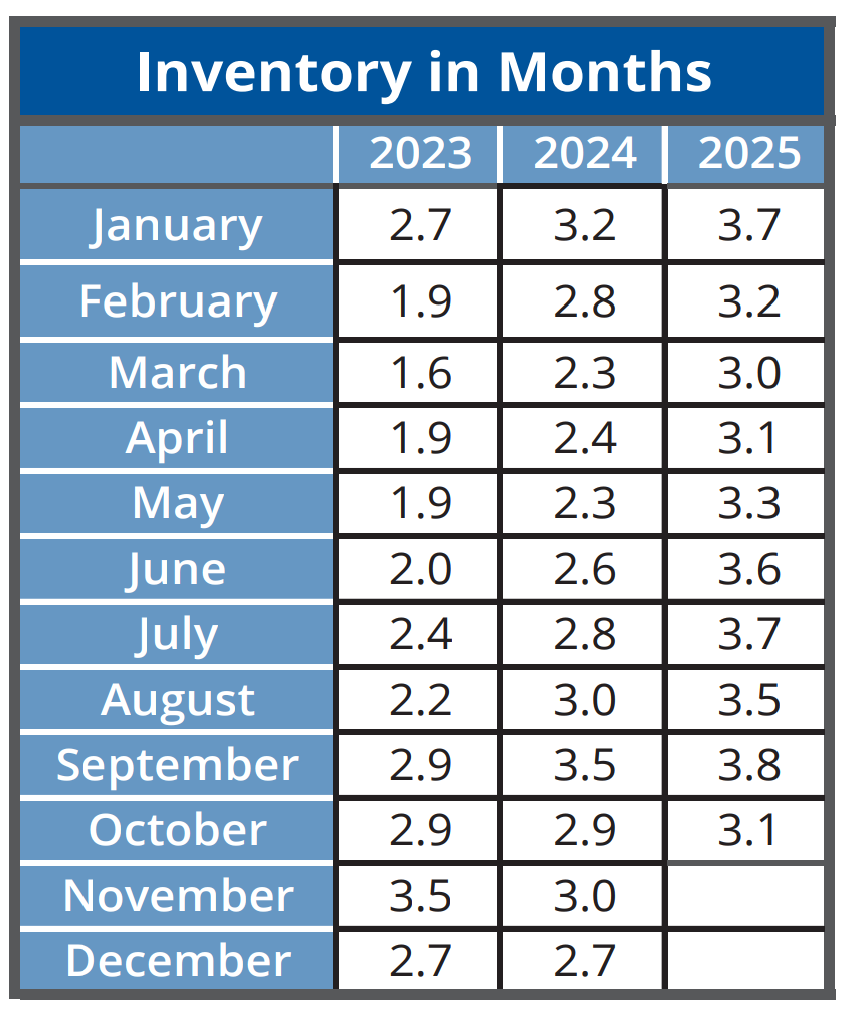

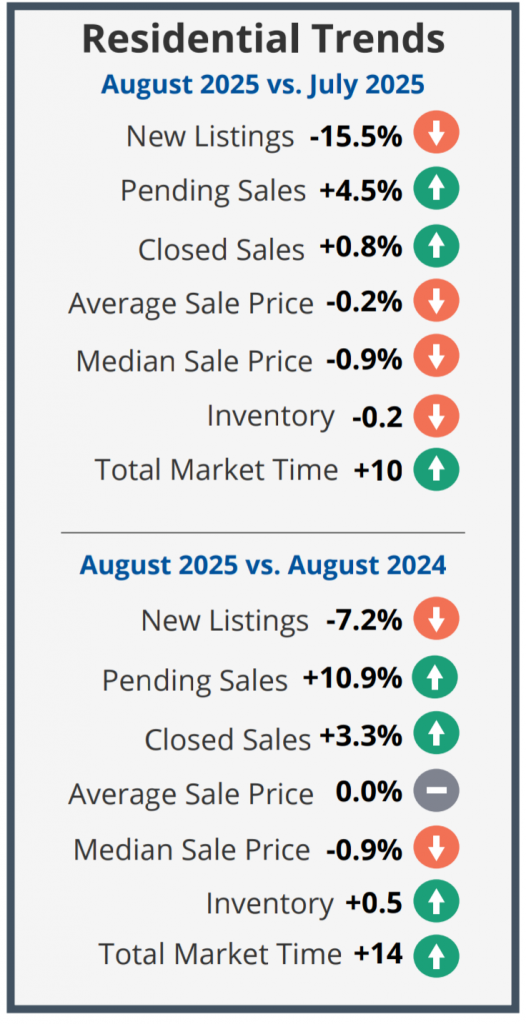

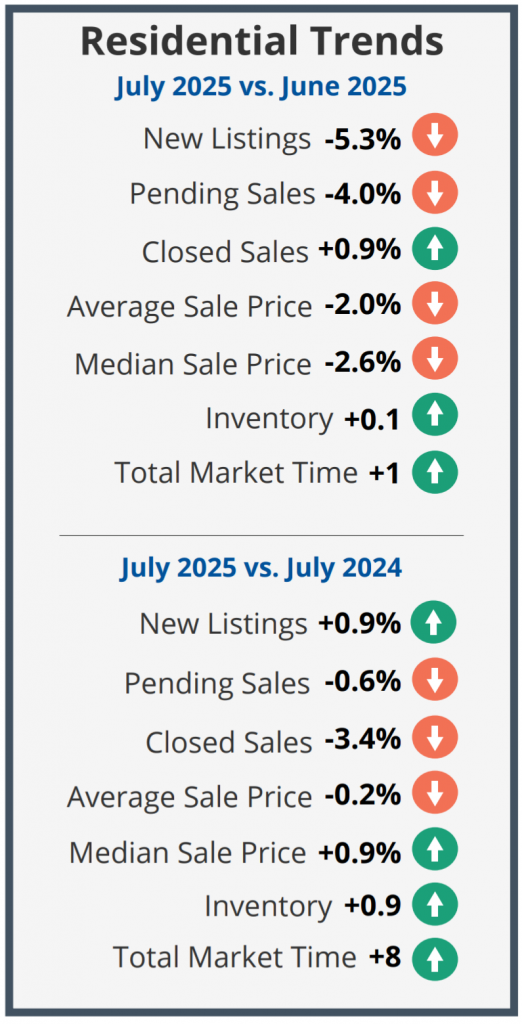

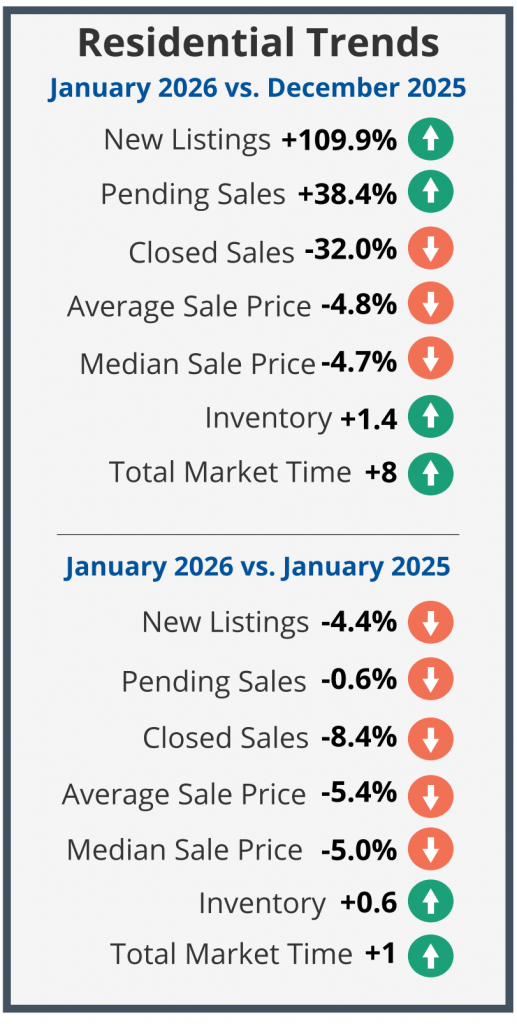

Well…there is a lot happening here. In the overall Portland area, January prices dropped by similar amounts to how much they rose last year at the same time…up then $28,000 & now down $35,000 from the years prior (Jan 2024 & 2025), and up then $22,000 to down now $28,000 from the months prior (Dec 2024 & Dec 2025). So, prices are stabilizing from the highs of 2025 and the number of New Listings just rose an incredible 109.9% from December. Plenty of newness in the Portland area! I believe a lot of people took their homes off the market during the holidays and are putting them back on now, and from the 38.4% rise in Pending sales from Dec’25 to Jan ‘26 it appears Buyers are out taking advantage of the exciting trends in 2026. This is great news for both Buyers and Sellers. Expect a busy Spring.

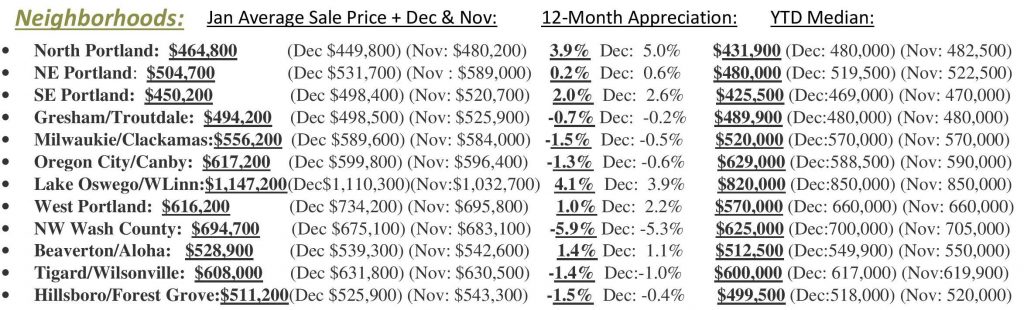

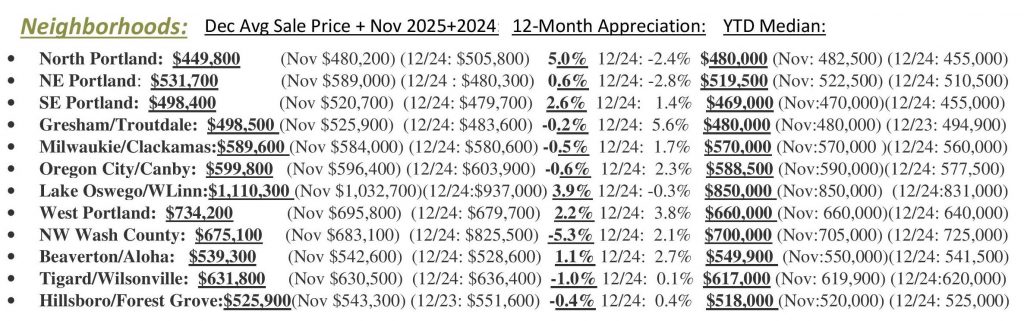

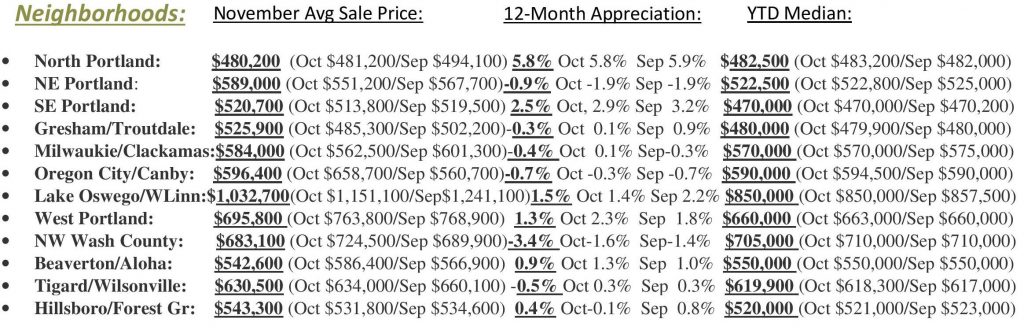

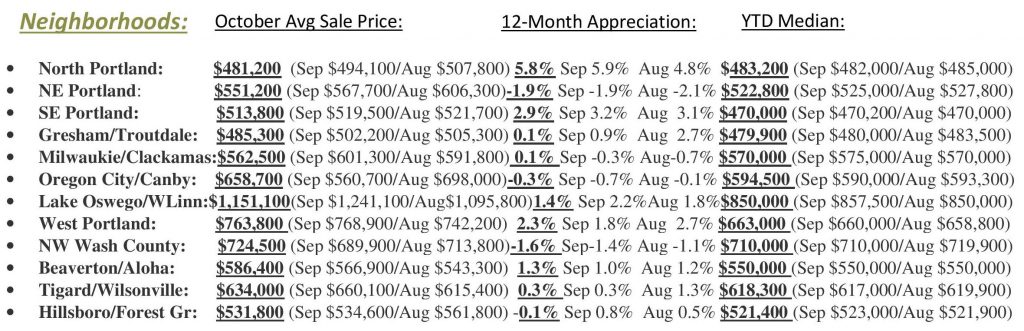

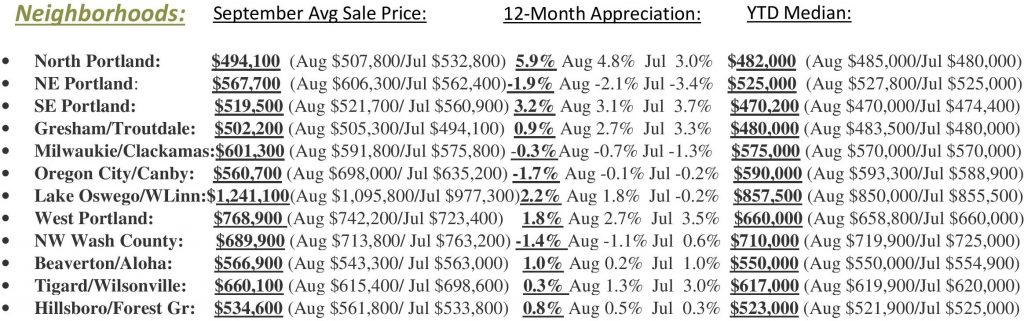

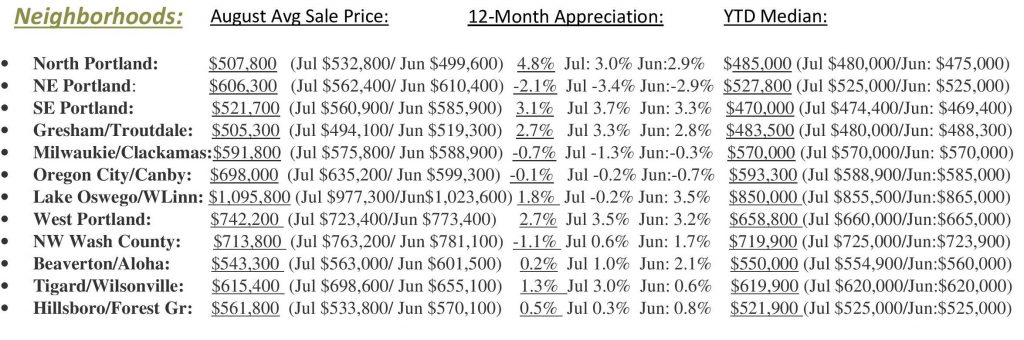

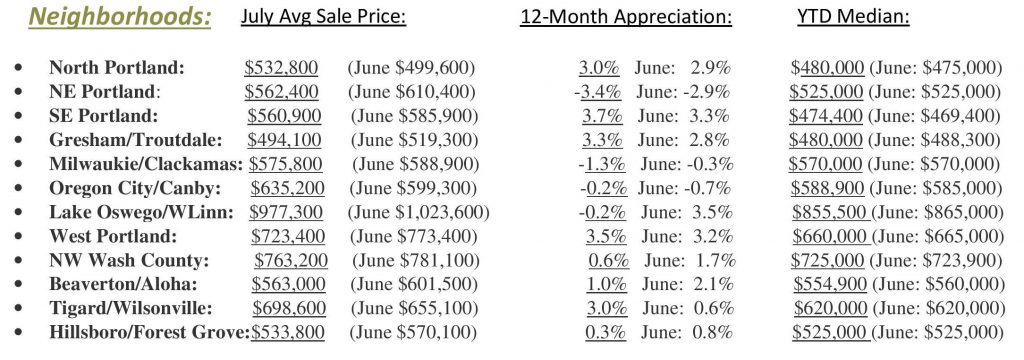

***Check out the Neighborhoods Breakdown at the bottom***

Rates: “Muted inflation numbers are helping the bond markets. Fixed rates are in the upper 5% range currently.” Gary Boyer, Certified Mortgage Planner, Premier Mortgage Resources

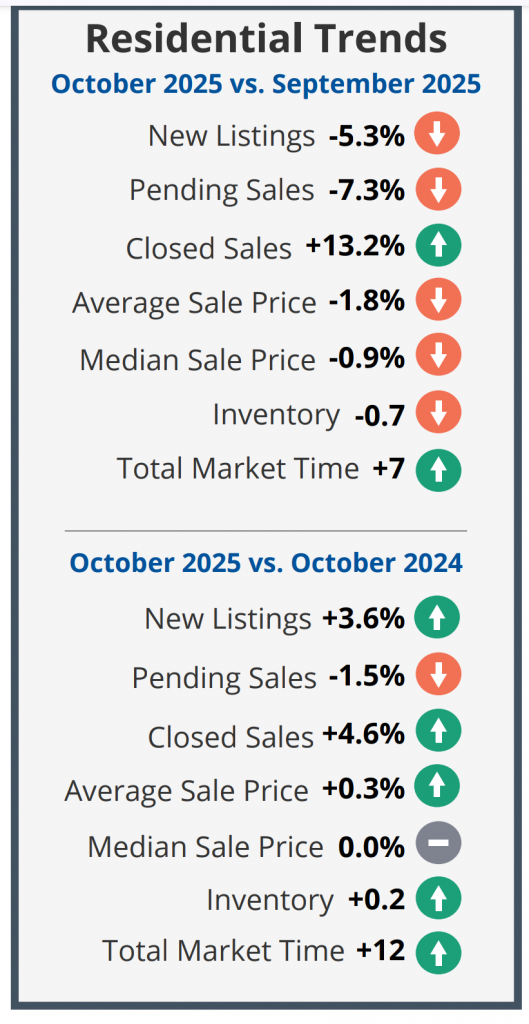

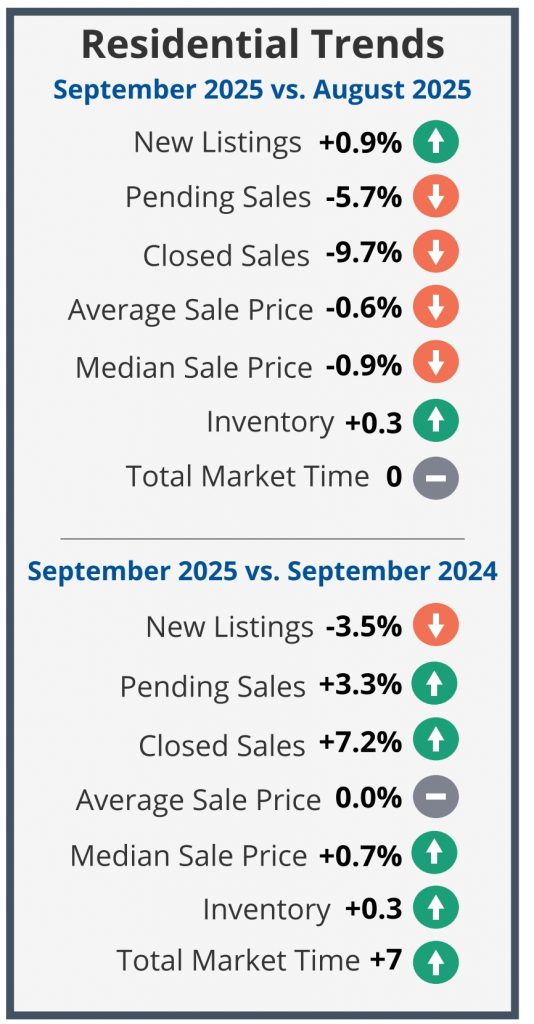

- There were 2,109 New Listings in January which decreased 4.4% from the 2,205 in Jan 2025, & increased an unheard-of 109.9% from the 1,005 in the previous month/Dec.

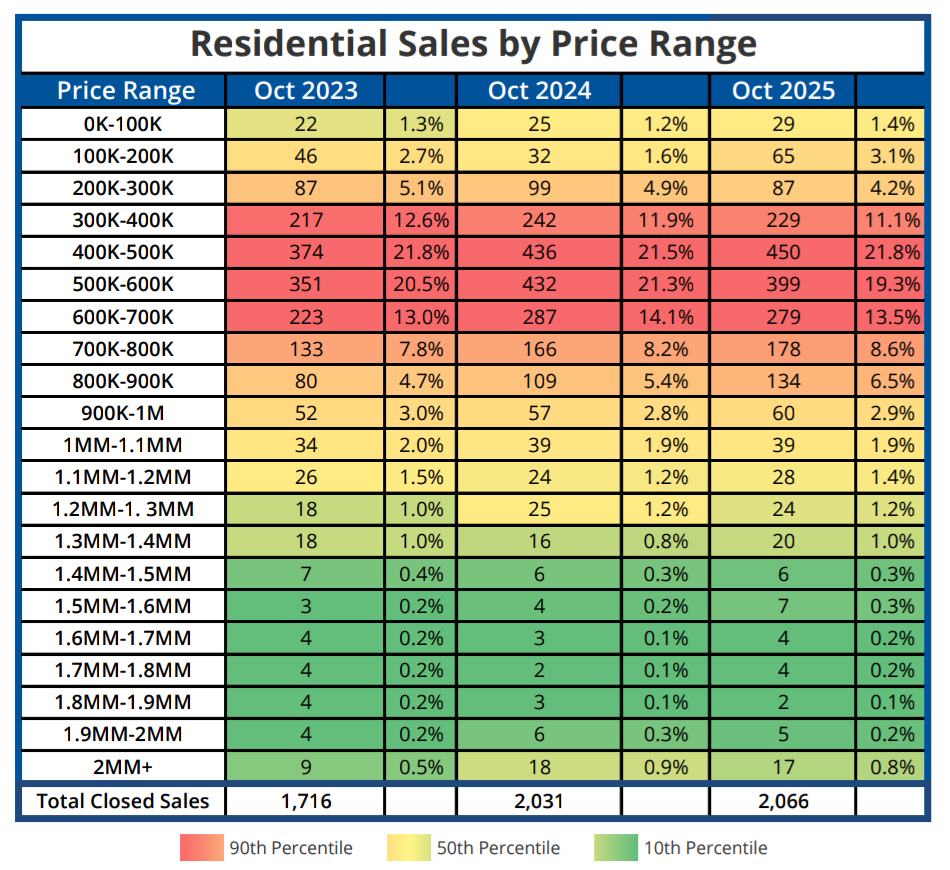

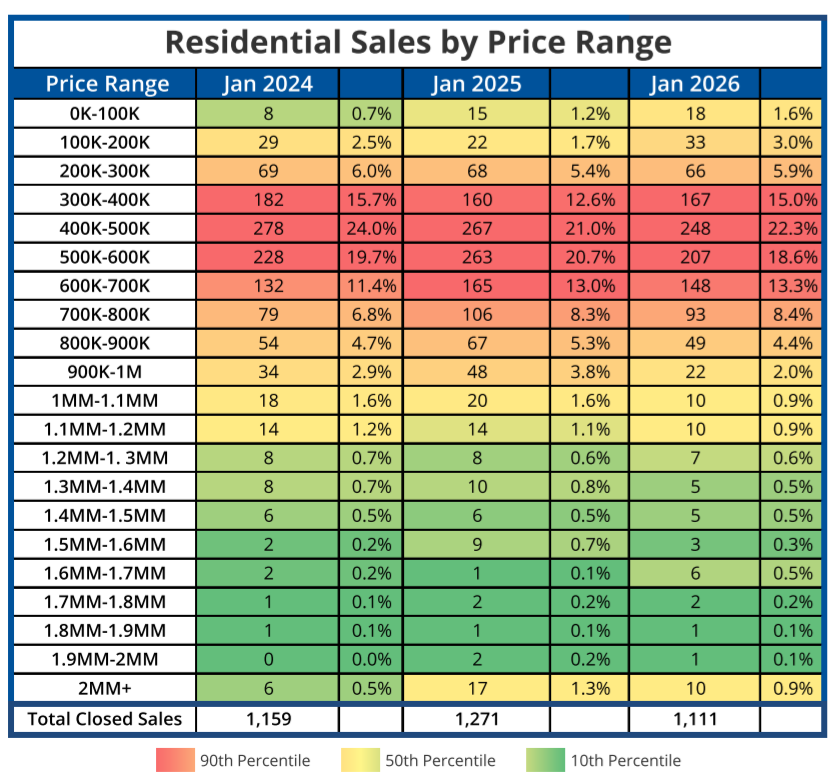

- At 1,111 January 2026’s Closed Sales (Solds) are down 8.4% from Jan 2025’s 1,213, and down 32.0% from the previous month’s total of 1,633.

- At 1,708 January’s Pending Sales (Accepted Offers) are down 0.6% from Jan 2025’s 1,326, and up a substantial 38.4% from the previous month/December’s total of 1,234 Accepted Offers.

- The Average Sale Price for January 2025 of, $568,000 is down $32,300. from last year /January 2025’s $600,300, and down $28,400 from the previous month/Dec’s $596,400.

- The “Median Sale Price” (the price smack dab in the middle of all sales) in January 2025 of $510,000 is down $27,000 from January 2025’s $537,000, & down $25,000 from the previous month’s $535,000.